Broker and consultant compensation disclosures

*Commissions are paid on up to five members per contract.

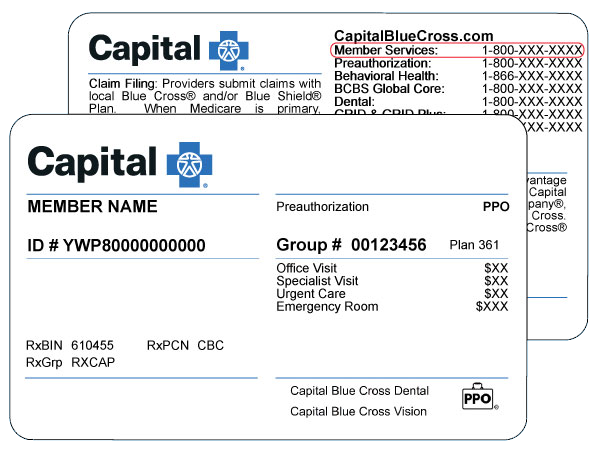

Healthcare benefit programs issued or administered by Capital Blue Cross and/or its subsidiaries, Capital Advantage Insurance Company®, Capital Advantage Assurance Company®, and Keystone Health Plan® Central. Independent licensees of the Blue Cross Blue Shield Association.Communications issued by Capital Blue Cross in its capacity as administrator of programs and provider relations for all companies