COVID-19 resources

Stay safe, stay informed

Check out this fact sheet to get details about Capital Blue Cross coverage for COVID-19 services.

Health plan coverage for COVID-19 testing, treatment, and vaccines

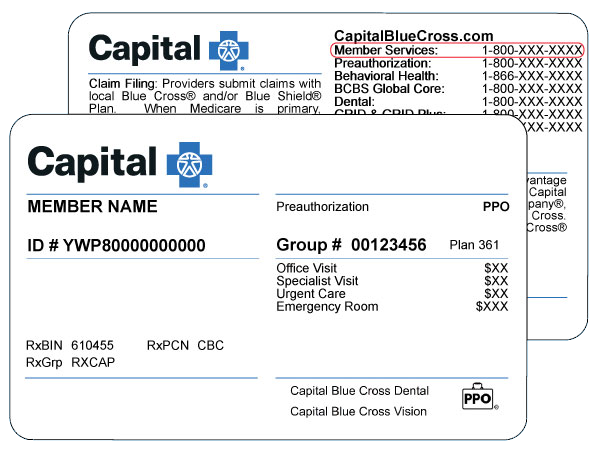

The information included here applies to coverage for most self-funded (or self-insured) employer-sponsored health and welfare plans, insured group plans and individual/family plans. To check the details for your coverage, refer to your Benefits Booklet (also called a Certificate of Coverage) or call the Member Services number on the back of your ID card (TTY:711). If you are covered through an employer, you can also ask your Human Resources Department if the coverage is self-funded or an insured group plan.

Members with Children's Health Insurance Program (CHIP) coverage through Capital Blue Cross can refer to the “CHIP coverage information” section on this page or call the number on the back of their ID card (TTY: 711) with questions about COVID-19 coverage for their plan.

Vaccines

Safety measures like COVID-19 vaccines are making a difference. People who get a vaccine are at lower risk of serious illness and hospitalization.

Members have coverage for COVID-19 vaccines as a preventive service with no cost share when you get a vaccine from an in-network provider. If you have prescription drug coverage with Capital Blue Cross, you can also get vaccines at no cost from an in-network retail pharmacy. We recommend you use MyCare Finder to find an in-network provider or pharmacy that accepts your plan’s benefits or prescription drug coverage with Capital Blue Cross. If you receive a vaccine from an out-of-network provider or pharmacy, you may have to pay out-of-pocket costs.

Safe and effective COVID-19 vaccines are available for everyone six months old and up. Vaccines can help individuals reduce the risk of getting seriously ill with COVID-19.

- Get more details about vaccines by visiting the Centers for Disease Control and Prevention’s COVID-19 vaccine webpage.

- Contact your provider if you have specific questions about vaccines.

- You can also find general information about vaccines, including for COVID-19, in our preventive vaccines FAQ.

Diagnostic testing

- Medically necessary COVID-19 diagnostic tests are covered; however, cost share may apply for services on or after May 12, 2023 based on your plan’s benefits. We recommend you use MyCare Finder to find an in-network provider that accepts your plan’s benefits.

- Testing for employment purposes or general tracking is not covered.

Over-the-counter (OTC) tests

- OTC tests for COVID-19 purchased on or after May 12, 2023 will not be covered through medical or pharmacy benefits. However, you can use your own personal HSA or FSA funds (if any) to pay for OTC tests.

Provider visits resulting in a COVID-19 test

- For services received on or after May 12, 2023, an office, urgent care, or emergency room visit resulting in a COVID-19 test will be covered; however, cost share may apply based on your plan’s benefits. We recommend you use MyCare Finder to find an in-network provider that accepts your plan’s benefits.

Inpatient treatment for COVID-19

- Inpatient treatment for COVID-19 is covered; however, any member cost share (such as deductibles, copays, and coinsurance) will apply based on your plan’s benefits.

Oral antivirals and monoclonal antibody treatments for COVID-19

- Oral antivirals and monoclonal antibodies prescribed on or after May 12, 2023 will be covered based on medical necessity of treatment related to COVID-19. Some services that were covered by regulation during the federal government’s COVID-19 public health emergency may no longer be considered medically necessary.

Children’s Health Insurance Program (CHIP) coverage information

The information included here applies to members with CHIP coverage through Capital Blue Cross. Please note that out-of-network services require prior authorization. We recommend you use MyCare Finder to find an in-network provider that accepts your plan’s benefits.

Vaccines

Safety measures like COVID-19 vaccines are making a difference. The Centers for Disease Control and Prevention (CDC) advises that COVID-19 vaccines can help protect people from serious illness and hospitalization.

- During the PHE, Capital Blue Cross began covering COVID-19 vaccines at no cost to members.

- When the PHE ends, members will continue to have coverage for COVID-19 vaccines as a preventive service with no cost share.

Safe and effective COVID-19 vaccines are available for everyone six months old and up. Here’s how to find more information about vaccines:

- Get more details about vaccines by visiting the CDC’s COVID-19 vaccine webpage.

- Contact your provider if you have specific questions about vaccines.

- You can also find general information about vaccines, including for COVID-19, in our preventive vaccines FAQ.

Diagnostic testing

- During the PHE, we began covering the cost of a COVID-19 diagnostic test without applying member cost share (such as copays) if performed because of an individualized clinical assessment, such as a test ordered by a provider or when a provider refers you for a test.

- We will continue to cover the cost of COVID-19 tests for CHIP members without applying member cost share through September 30, 2024.

- Testing for employment purposes or general tracking is not covered.

Over-the-counter (OTC) tests

- During the PHE, the federal government began requiring health plans to cover up to eight at-home, OTC tests per member every 30 days.

- We will continue to cover eight at-home tests every 30 days for CHIP members through September 30, 2024.

Get details on OTC test coverage in this FAQ about OTC tests.

Provider visits resulting in a COVID-19 test

- During the PHE, we began covering office, urgent care, or emergency room visits during which a COVID-19 test is deemed necessary or is given by a provider is covered with no member cost share.

- We will continue to cover these services with no member cost share for CHIP members through September 30, 2024.

Inpatient treatment for COVID-19

Inpatient treatment for COVID-19 is covered with no cost share for CHIP members.

Oral antivirals and monoclonal antibody treatments for COVID-19

- During the PHE, we began covering COVID-19 drugs and biological products (such as monoclonal antibody treatments) with no cost sharing.

- We will continue to cover COVID-19 drugs and biological products with no cost sharing for CHIP members through September 30, 2024.

Claims and appeals

- In many cases, members had extra time to file a claim or an appeal during the federal government’s COVID-19 public health emergency (PHE). If you are a member who gets your insurance through your employer or through an individual/family policy, a temporary rule gave you extra time to file claims and appeals while the PHE remained in effect. For example, most members had up to 180 days to file an appeal from the date of an adverse benefit decision, such as a claim denial. The temporary rule gave you up to one additional year to file an appeal, so you had the normal 180 days plus one additional year. If your insurance is from a state or local government plan, you may not have been eligible for extra time since the temporary rule did not apply to those plans. The temporary rule expired on July 10, 2023.

- Please keep in mind that the temporary rule ended 60 days after the PHE ended, and normal claims and appeals deadlines went back into effect at that time. A claim or appeal submitted on or after July 11, 2023 must be within the number of days allowed for a claim or an appeal as specified in your Benefits Booklet and on the back of any Explanation of Benefits (EOBs) you receive.

Telehealth and teledentistry

-

Telehealth

Members may use telehealth to connect remotely by video with in-network providers for services covered under their health plan. Members may also connect with providers by phone. Check your Benefits Booklet for details about telehealth coverage.

-

VirtualCare

Our VirtualCare benefit offers another effective way for members to get care, including behavioral health services and nutrition counseling. It can be a convenient option if you get sick while traveling in the U.S., when you don’t feel well enough to leave the house or the weather is bad, or if your doctor’s office is closed. VirtualCare doctors can diagnose common illnesses and send prescriptions straight to your pharmacy.

VirtualCare is covered by most Capital Blue Cross health plans. To check on your coverage, refer to your Benefits Booklet or call the Member Services number on the back of your ID card (TTY: 711) for assistance."

-

Teledentistry

For members with Capital Blue Cross Dental coverage, in-network teledentistry consultations are covered by your plan. If you'd prefer to have a teledentistry visit, contact your dentist's office to see if teledentistry visits are available.

Need health coverage?

- We can help find coverage. Call 855.505.2583 (TTY: 711) to speak to one of our licensed agents about your options.

Additional resources

- Visit the Centers for Disease Control and Prevention’s COVID-19 resource page for details on topics such as vaccines, symptoms, and testing.

- You can also find up-to-date information on vaccines and treatments on the U.S. Food and Drug Administration’s webpage.

- Capital Blue Cross offers many tools to help you stay healthy. Check out the wellness tools and resources that may be available through your plan.