Premium payments

Payment options

Learn more about each payment option.

Check It Out®

- Set up automatic premium payments from your bank account. Fill out our Check it Out® form to get started. Payments will be pulled from your account on the first of each month. When your request has been processed, you will receive a confirmation letter in the mail and paper bills will be discontinued.

- If you receive a bill after signing up for Check It Out®, this means the request hasn’t been processed yet. Please use another form of payment for that month, to avoid cancellation.

- We recommend paying your current invoice directly while you set up automatic payments to allow for processing time.

- Check It Out® FAQ

eCheck/credit card

Make direct payments online or over the phone:

- Online - Make a one-time payment for the amount you choose, or set up monthly recurring payments. You control when you make your payment.

- Call 833.496.7321 - Make one-time payments any day, any time, by calling our automated payment line. You control when you make your payment.

Bill payer

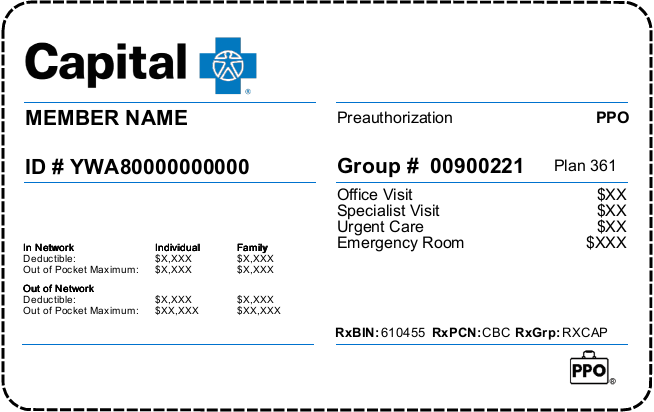

Capital Blue Cross participates with most banks and credit unions to receive electronic payments. Simply add us to your payee list using the first 9 numeric digits of your member ID number on your ID card or invoice, then follow your bank’s instructions to set up payments.

- Capital Blue Cross cannot change or cancel direct payments on your behalf. Please work directly with your bank or financial institution.

Check

Checks can be made payable to:

Payment Processing

PO Box 371482

Pittsburgh, PA 15250-7482

Update payment information

Payment method

Has your credit card expiration date changed, or would you like to replace your current card with a new card number?

You can update your payment method from your secure account. When logged in, select Pay My Premium under My Balances, then click the account name in the upper right corner and select Payment Accounts.

On your Payment Accounts screen, you can update the expiration date using the pencil icon, delete the existing payment account using the trash can icon, or add a new payment method.

When finished, confirm your AutoPay is attached to the correct payment method.

Recurring payment

In the AutoPay dashboard, you can change your payment method, view authorizations, or delete your AutoPay arrangement. To change your recurring payment, log in to your secure account, select Pay My Premium under My Balances, select AutoPay, and choose review/edit/delete.

If you need to change your AutoPay scheduled date, delete your current payment method and add a new one with the corrected date.

Things to know

First payment

To make sure your benefits are active on your plan start date, please make your first payment prior to this date to allow for processing.

Multiple policies

If you have more than one policy (such as a medical and dental plan), please make two payments. Your overpayment on one policy will not be automatically processed to your second policy.

Late enrollment

If you enrolled late (after the 15th of the prior month), you have 30 days to complete your first payment. Due dates for following payments will not adjust. This means your first and second months’ payments may be due at the same time.