FAQ

Find answers to frequently asked questions about health insurance, and general account and plan information.

What counties are included in the Capital Blue Cross service area?

The Capital Blue Cross service area includes the Adams, Berks, Centre, Columbia, Cumberland, Dauphin, Franklin, Fulton, Juniata, Lancaster, Lebanon, Lehigh, Mifflin, Montour, Northampton, Northumberland, Perry, Schuylkill, Snyder, Union and York counties.

Does everyone in my family need to have the same primary care provider (PCP)?

No.

What if I get sick out of Capital Blue Cross’s coverage area?

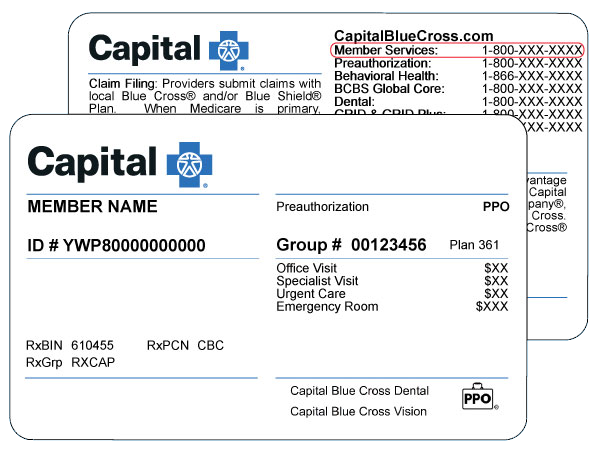

Your member ID card opens doors to hospitals and doctors across the United States participating in the Blue Cross Blue Shield network. They’ll accept our payment as payment in full for covered services subject to member cost share, reducing your out-of-pocket expense. You may be responsible for more of the cost with non-participating providers or specialty care.

What if I travel outside of the country?

Your benefits travel with you! There are Blue Cross Blue Shield Association-participating hospitals and doctors in over 200 countries.

- Find a doctor through Blue Cross Blue Shield Global Core or download the Blue Cross Blue Shield Global Core App.

- If you’re able to visit a participating provider while abroad, just show your ID card.

- If you must see a non-participating provider, ask for an itemized copy of your bill. You may have to pay this bill out-of-pocket. When you get home, submit a claim to us for possible reimbursement.

- If you want a more robust, concierge-level health plan while abroad, explore plans from GeoBlue®1.

My question isn’t answered here.

Please contact us online or visit one of our Capital Blue Cross Connect health and wellness centers for in-person assistance. You may also call the Member Services number on the back of your member ID card.

Secure account

How do I retrieve my username?

On the Capital Blue Cross login screen, select Forgot username?, and enter the email address you used to create your secure account. We’ll send your username to that email address.

For additional help, call the Member Services number on the back of your ID card.

How do I reset my password?

On the Capital Blue Cross login screen, select Forgot password?, enter your username, and answer your challenge questions to create a new password.

If you cannot recall the answers to your challenge questions or for additional help, call the Member Services number on the back of your ID card.

When should I clear my browser’s cache and cookies?

Over time, cached data and cookies can accumulate on your device and interfere with your browser’s performance. If you are having trouble logging in to your secure account, clear your browser’s cache and cookies. We’ve included links to instructions for commonly used browsers for your convenience:

Try logging in again after you’ve cleared your cache and cookies. If trouble persists, call the Member Services number on the back of your ID card.

What if I didn’t receive my two-step authentication code?

Some carriers may require you to text START to 86402 to allow SMS/text messaging to receive your two-step authentication code. Message and data rates may apply. Please check with your wireless provider.

For additional help with your two-step authentication, please call 800.793.4559 for assistance.

How do I stop text messages for two-step-authentication?

Text STOP to 86402 to cancel two-step authentication messages. If you text STOP and unsubscribe from receiving SMS/text messages related to two-step authentication, you will no longer receive your secure account verification code by SMS/text.

To access your secure account, you should set up another device to receive your verification code by email or voice call. Add a device under My Profile in your secure account.

If you need help with setting up another device or have a different concern with your two-step authentication, please call 800.793.4559 for assistance.

How can I get help with my two-step authentication?

Please call 800.793.4559 for assistance.

Individual plans

Can I pay my premium in person?

Yes. You can pay your premium at one of our Capital Blue Cross Connect health and wellness centers.

Can I pay my premium automatically?

Yes. Enroll in Check It Out® to give us access to your bank account.

Can I designate a third party to help me remember to pay my premium?

Yes. Enroll in Entrust®. When you are signed up and your bill is past due, we will send your final billing notice to your designated family member, friend, or agency. They can remind you to pay your premium and avoid cancellation.

How can I submit a cancellation due to death and/or receive a refund for their premium?

What to do when a member passes away

Capital Blue Cross and its family of companies sends you our deepest condolences for you and for your family. We are here to help you through the process of canceling the contract and issuing a refund, should a refund be due.

To better serve you, please answer a few questions.

Copays and coinsurance

What does coinsurance mean?

Coinsurance refers to the amount of money you pay for covered health care after your deductible is met. The amount of coinsurance included with a plan is indicated by a percentage, and this percentage can vary between plans.

How does coinsurance work?

If your plan includes a coinsurance percentage, it will begin to apply after you have paid your deductible. For example, if your plan includes 20% coinsurance, you will pay 20% of your bill, and your plan will cover the remaining 80%. Example: if your health insurance plan has 20% coinsurance and you have a $100 doctor bill, insurance will pay $80 and you pay $20, after your deductible is met.

It is important to note that coinsurance applies only after the plan deductible is met. Until the deductible is met, the member is responsible for 100% of costs of certain health care.

What is a copay?

A copayment, or "copay" for short, is a flat fee you pay for health care, or when you fill a prescription. Copays do not usually count towards your deductible, and you may owe a copay for services even after your deductible is met.

How do copays work?

Your health insurance plan will include information on the copay amount for certain services. You can find this information on your health insurance card, or in your plan documents.

If your plan has a copay for your primary care physician, you will pay the copay amount each time you visit. Likewise, if your plan has a copay for prescription drugs, you will pay that amount each time you refill your drugs at the pharmacy or through mail-order.

Deductibles

What is a deductible in health insurance?

Your health insurance deductible is the amount you pay towards your health care before the insurance company begins to pay.

How do health insurance deductibles work?

Most health insurance plans include a deductible, which is the amount the member is responsible to pay before insurance begins to pay a larger share of claims. Your insurance will cover all or a portion of your costs (coinsurance) when you meet your yearly deductible.

It's important to note that many wellness screenings and preventive care may be covered before you meet your deductible. Check your specific health insurance plan for more details.

How does a prescription drug deductible work?

Like other deductibles, a prescription drug deductible is the amount the member pays towards prescription drugs before the insurance plan begins to contribute a larger share. Please note, if you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible.

What are out-of-pocket costs?

Out-of-pocket are additional costs you pay outside the premium, like copays, coinsurance, and deductibles. There are out-of-pocket maximums on plans and once that is met each year the insurance plan pays 100% of covered costs.

Explanation of Benefits (EOBs)

What is an Explanation of Benefits?

An Explanation of Benefits, or "EOB" for short, is a statement that your health insurance company provides to explain the costs it will cover for health care services you receive. This statement will show the amount that the insurance company will pay, as well as the amount for which the member is responsible. An Explanation of Benefits is generated for every health care visit.

How are EOBs bundled?

What do EOBs look like online?

When you log in to your secure member account, you see individual claims listed by provider. However, the "View EOB" icon next to each claim brings up the same bundled EOB you receive in the mail.

If a claim is finalized before the bundled Explanation of Benefits is generated, you see the individual claim information as soon as that claim is finalized.

What are the differences between in-network and out-of-network (OON) EOBs?

Since there is not a member rate for out-of-network services, you see "Allowed Amount" instead of "Your Member Rate" on out-of-network Explanation of Benefits. In addition, OON EOBs are not bundled and go out on a per claim basis, unless you receive multiple services by the same provider on the same day.

In you receive an in-network and OON EOB on the same day, they are mailed together in the same envelope.

Remember, you can save money by choosing in-network providers.

How can I get more information?

If you have additional questions about your Explanation of Benefits, you can contact us or call the number on the back of your member ID card.

Where on my EOB can I see my deductible, copay, and coinsurance amounts?

You can see how much of your member and/or family deductible you have met on the bar chart(s) in the “Explanation of Benefits” section. You can find your copay/coinsurance amounts in the “Care Detail” section, along with the amount applied to your deductible and the amount you owe.

What is the “Amount You Owe” section?

This is the total amount you owe your provider(s) for the services you received. This may include your copay, coinsurance, any deductible you still need to meet, and any services that your benefits don’t cover. If you already paid your provider(s) all or part of this amount during your visit, make sure that amount is credited on your future bill.

What does it mean if the “Amount We Paid” section on an EOB shows $0?

You may see $0 if the services you received aren’t covered under your plan, if the cost went toward paying your copay, coinsurance, or deductible, or if they were paid by another insurer.

What are eligible services?

Eligible services are those that are covered under your health plan. Log in to your secure account to review your benefits.

1GeoBlue is a trademark name of Worldwide Insurance Services, LLC, an independent licensee of the Blue Cross Blue Shield Association. All plans are underwritten by 4 Ever Life Insurance Company, an independent licensee of the Blue Cross Blue Shield Association.